Just How Livestock Risk Security (LRP) Insurance Policy Can Safeguard Your Livestock Investment

In the realm of animals financial investments, mitigating threats is extremely important to ensuring monetary security and growth. Animals Threat Security (LRP) insurance stands as a reputable shield against the unpredictable nature of the market, providing a critical method to securing your assets. By diving right into the ins and outs of LRP insurance coverage and its complex benefits, animals manufacturers can strengthen their investments with a layer of protection that transcends market fluctuations. As we check out the realm of LRP insurance policy, its duty in securing livestock investments ends up being increasingly obvious, assuring a path in the direction of sustainable financial resilience in a volatile industry.

Understanding Livestock Danger Protection (LRP) Insurance Coverage

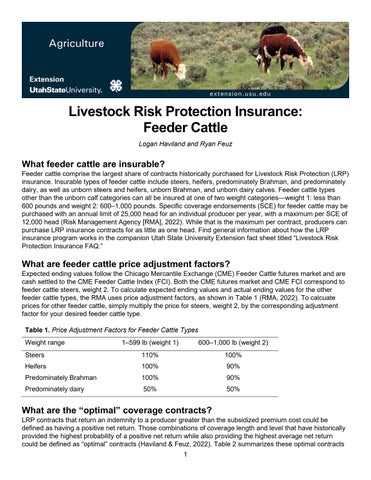

Understanding Animals Threat Security (LRP) Insurance policy is essential for animals manufacturers seeking to minimize monetary threats related to rate fluctuations. LRP is a federally subsidized insurance product designed to protect producers against a decrease in market costs. By supplying protection for market value declines, LRP assists producers secure a flooring cost for their livestock, making sure a minimum level of revenue regardless of market changes.

One key facet of LRP is its adaptability, permitting manufacturers to personalize insurance coverage levels and policy lengths to match their particular needs. Manufacturers can pick the variety of head, weight array, insurance coverage rate, and protection period that line up with their production goals and run the risk of tolerance. Comprehending these customizable choices is essential for manufacturers to effectively handle their price danger exposure.

Additionally, LRP is available for various livestock kinds, consisting of livestock, swine, and lamb, making it a functional risk management device for animals manufacturers throughout different fields. Bagley Risk Management. By acquainting themselves with the complexities of LRP, manufacturers can make educated decisions to guard their financial investments and ensure financial security when faced with market uncertainties

Benefits of LRP Insurance Policy for Animals Producers

Livestock manufacturers leveraging Animals Threat Security (LRP) Insurance get a calculated advantage in protecting their investments from price volatility and protecting a secure monetary ground in the middle of market unpredictabilities. One crucial advantage of LRP Insurance is price defense. By establishing a floor on the price of their animals, producers can reduce the risk of substantial economic losses in case of market declines. This enables them to intend their spending plans a lot more successfully and make notified decisions concerning their procedures without the consistent worry of cost changes.

Furthermore, LRP Insurance policy provides manufacturers with comfort. Knowing that their financial investments are protected against unanticipated market changes allows manufacturers to concentrate on other elements of their service, such as improving animal wellness and well-being or maximizing production processes. This satisfaction can lead to increased efficiency and earnings in the future, as producers can operate with even more self-confidence and security. In general, the benefits of LRP Insurance for animals producers are considerable, using an important device for managing danger and guaranteeing financial safety and security in an uncertain market atmosphere.

Just How LRP Insurance Coverage Mitigates Market Dangers

Mitigating market risks, Animals Threat Security (LRP) Insurance offers livestock manufacturers with a trusted guard versus cost volatility and financial uncertainties. By supplying defense against unexpected cost declines, LRP Insurance assists manufacturers secure their investments and preserve economic security despite market changes. This sort of insurance enables livestock producers to secure in a rate for their pets at the beginning of the policy period, making sure a minimum cost degree no matter of market changes.

Actions to Protect Your Animals Investment With LRP

In the world of farming risk monitoring, executing Animals Danger Defense (LRP) Insurance involves a calculated process to secure financial investments against market variations and uncertainties. To safeguard your animals investment efficiently with LRP, the very first step is to examine the specific threats your operation deals with, such as price volatility or unanticipated weather condition events. Comprehending these threats enables you to determine the protection recommended you read level required to safeguard your financial investment appropriately. Next, it is important to research and choose a trusted insurance policy carrier that supplies LRP policies customized to your animals and organization requirements. Very carefully review the policy terms, conditions, and insurance coverage limitations to ensure they line up with your risk monitoring objectives as soon as you have actually picked a service provider. In addition, on a regular basis keeping track of market fads and readjusting your coverage as needed can aid enhance your security versus possible losses. By adhering to these actions vigilantly, you can enhance the security of your livestock investment and browse market uncertainties with self-confidence.

Long-Term Financial Protection With LRP Insurance

Guaranteeing enduring economic stability through the application of Animals Danger Security (LRP) Insurance policy is a prudent long-lasting strategy for farming producers. By integrating LRP Insurance into their threat administration strategies, farmers can secure their livestock investments against unforeseen market fluctuations and adverse occasions that can jeopardize their monetary health with time.

One trick advantage of LRP Insurance policy for long-term monetary protection is the comfort it supplies. With a reputable insurance coverage policy in position, farmers can reduce the economic dangers related to volatile market problems and unanticipated losses as a result of factors such as disease episodes or all-natural catastrophes - Bagley Risk Management. This security enables producers to concentrate on the daily operations of their livestock business without continuous bother hop over to these guys with possible monetary obstacles

Moreover, LRP Insurance policy provides an organized technique to handling risk over the long-term. By setting details insurance coverage levels and picking proper endorsement periods, farmers can tailor their insurance policy plans to line up with their financial goals and run the risk of tolerance, ensuring a sustainable and safe future for their livestock operations. To conclude, buying LRP Insurance is a proactive method for farming producers to accomplish long lasting economic protection and shield their source of incomes.

Final Thought

Finally, Livestock Danger Security (LRP) Insurance is an important device for animals manufacturers to reduce market dangers and safeguard their financial investments. By understanding the advantages of LRP insurance coverage and taking actions to implement it, producers can accomplish lasting economic protection for their operations. LRP insurance offers a safety and security web versus price changes and ensures a degree of security in an unforeseeable market environment. It is a wise option for securing animals financial investments.

Comments on “Specialist Assistance: Bagley Risk Management Strategies”